9 Easy Facts About Guided Wealth Management Shown

9 Easy Facts About Guided Wealth Management Shown

Blog Article

The Ultimate Guide To Guided Wealth Management

Table of ContentsMore About Guided Wealth ManagementGuided Wealth Management - An OverviewThe Guided Wealth Management PDFsSome Of Guided Wealth ManagementThe Single Strategy To Use For Guided Wealth Management

For investments, make repayments payable to the product company (not your advisor). Offering a monetary consultant total access to your account boosts risk.If you're paying a recurring recommendations fee, your adviser should evaluate your monetary scenario and meet you at the very least yearly. At this conference, make certain you talk about: any kind of changes to your objectives, circumstance or finances (consisting of adjustments to your income, expenditures or possessions) whether the level of danger you fit with has changed whether your existing individual insurance coverage cover is appropriate how you're tracking against your objectives whether any kind of changes to legislations or monetary products can impact you whether you've obtained everything they guaranteed in your arrangement with them whether you need any modifications to your strategy Annually a consultant must seek your created grant charge you recurring guidance charges.

This may happen during the meeting or digitally. When you get in or restore the continuous charge setup with your adviser, they ought to describe exactly how to finish your partnership with them. If you're transferring to a new consultant, you'll need to organize to move your economic documents to them. If you need assistance, ask your advisor to describe the process.

The Best Strategy To Use For Guided Wealth Management

As an entrepreneur or small organization proprietor, you have a lot going on. There are several obligations and costs in running a business and you definitely don't require an additional unnecessary costs to pay. You require to thoroughly think about the return on investment of any solutions you reach make sure they are worthwhile to you and your company.

If you are just one of them, you might be taking a substantial threat for the future of your service and on your own. You might wish to keep reading for a checklist of reasons that working with a monetary advisor is advantageous to you and your service. Running a service has plenty of obstacles.

Cash mismanagement, capital problems, delinquent repayments, tax obligation problems and various other financial problems can be essential enough to close an organization down. That's why it's so important to manage the monetary facets of your business. Employing a reliable financial expert can avoid your company from going under. There are several manner ins which a qualified financial consultant can be your partner in assisting your service grow.

They can work with you in reviewing your financial scenario regularly to avoid severe errors and to rapidly correct any bad money choices. A lot of look these up little company owners wear several hats. It's easy to understand that you want to save money by doing some tasks yourself, yet taking care of financial resources takes understanding and training.

Some Known Questions About Guided Wealth Management.

Planning A service plan is essential to the success of your organization. You require it to understand where you're going, how you're getting there, and what to do if there are bumps in the roadway. A good financial expert can put together a detailed plan to assist you run your business a lot more successfully and plan for anomalies that emerge.

A credible and experienced economic consultant can lead you on the investments that are appropriate for your service. Money Savings Although you'll be paying a monetary consultant, the lasting savings will certainly warrant the cost.

Decreased Stress As a business owner, you have whole lots of things to stress about. A good monetary advisor can bring you peace of mind recognizing that your financial resources are obtaining the attention they require and your money is being spent intelligently.

How Guided Wealth Management can Save You Time, Stress, and Money.

Security and Development A certified financial expert can offer you clearness and help you concentrate on taking your company in the ideal instructions. They have the tools and resources to employ strategies that will certainly ensure your service expands and grows. They can assist you analyze your goals and determine the most effective path to reach them.

Guided Wealth Management Can Be Fun For Everyone

At Nolan Accountancy Facility, we supply competence in all elements of monetary preparation for small companies. As a local business ourselves, we understand the difficulties you encounter each day. Offer us a telephone call today to go over how we can assist your company prosper and do well.

Independent ownership of the technique Independent control of the AFSL; and Independent commission, from the client only, through a set buck charge. (https://www.video-bookmark.com/bookmark/6453473/guided-wealth-management/)

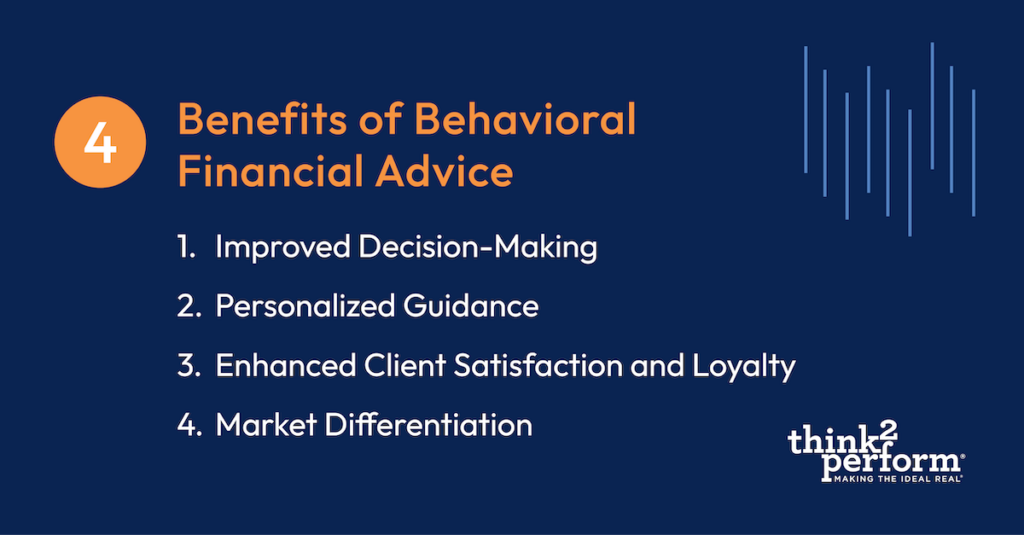

There are numerous advantages of a monetary organizer, regardless of your scenario. The objective of this blog site is to confirm why everybody can benefit from a financial plan. financial advice brisbane.

Report this page